CannabisDeals Weekly Price Snapshot

Week starting: December 15, 2025

Executive Summary

Week ending: December 26, 2025

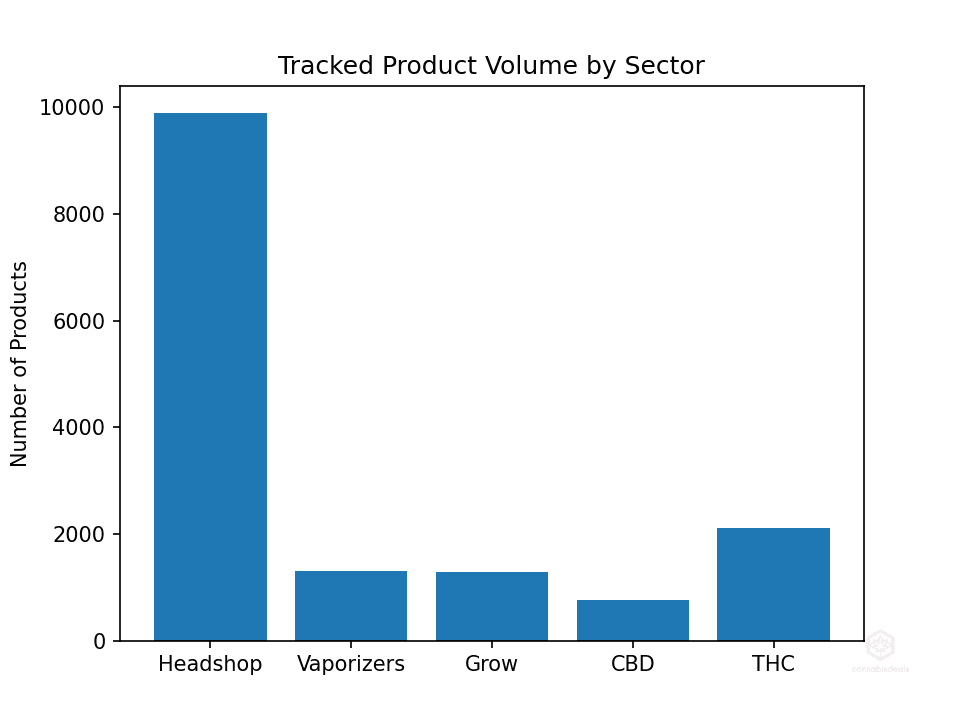

This week’s snapshot covers 15,601 tracked products and shows a clear split between

discount driven THC consumables and steadier pricing across non consumable categories.

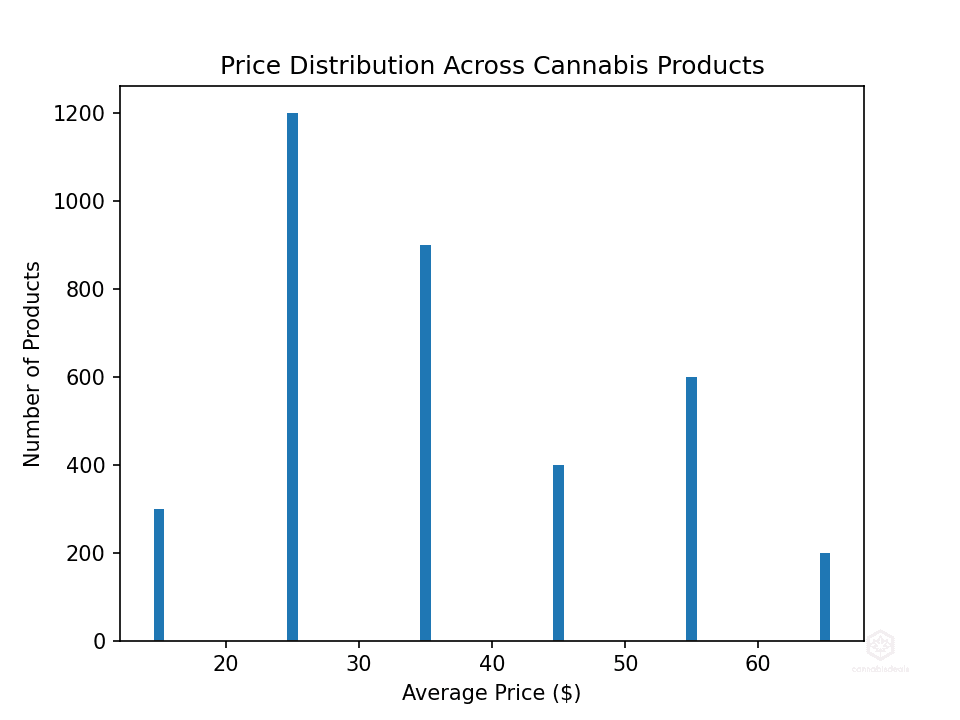

Overall pricing remains stable, with movement driven mainly by targeted promotions rather than broad price cuts. This week’s pricing picture suggests a modest softening in the market rather than a structural shift. The index points to a small week over week decline, which is most consistent with targeted promotional activity and category mix effects.

Weekly headline stats

- Index level: 97

- Products in snapshot: 15,601

- Products with valid price: 15,594

- Average effective price: $53.47

- Median effective price: $29.99

- Middle 50% price range: $17.50 – $59.99

- Products on sale: 11.7%

- Average discount: 4.7%

Key Insights

- THC drives most discount activity.

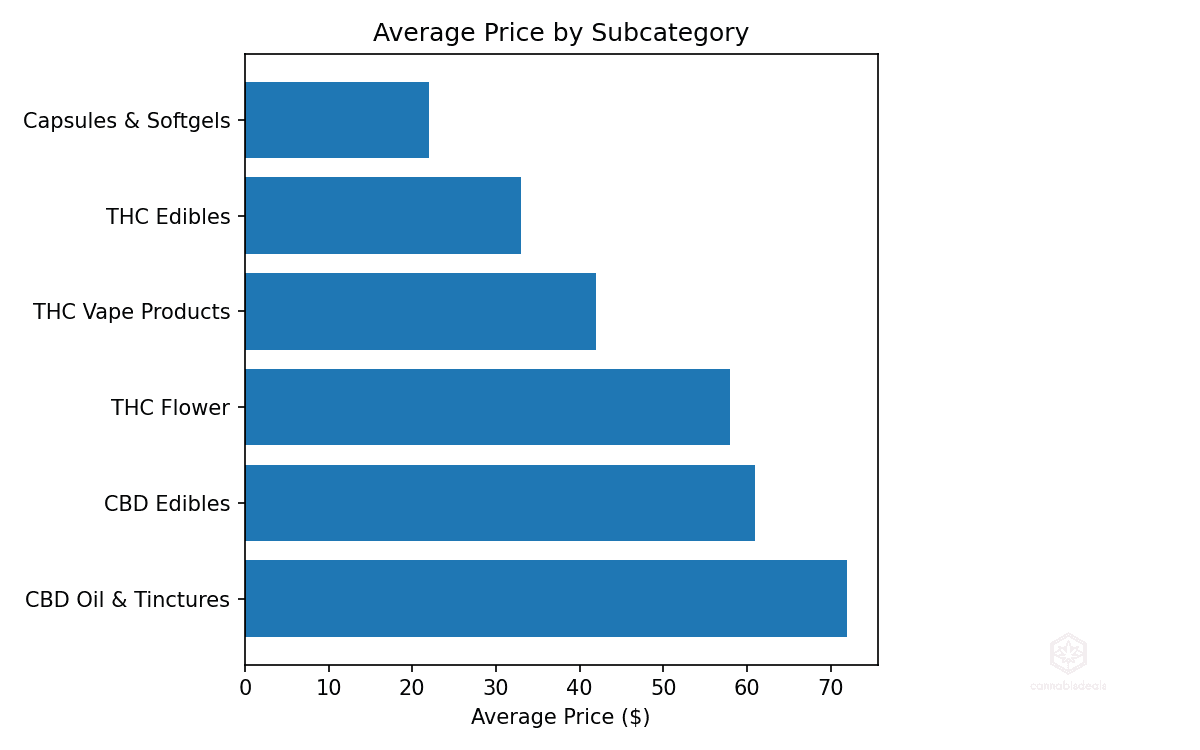

Discounting is concentrated in THC consumables, especially edibles and pre rolls, which combine lower average prices with deeper promotions. - CBD pricing remains stable but varies by format.

CBD oils and tinctures hold higher price points with moderate discounting, while CBD edibles face greater promotional pressure. - Non consumable categories anchor pricing.

Headshop, vaporizers, and grow products dominate volume and show minimal discounting, stabilizing the overall price distribution. - Clear price stratification persists.

Most products cluster in the mid price range, with a smaller premium tier supporting higher margin purchases. - Pricing discipline remains intact.

The low share of discounted products suggests focused promotional tactics rather than broad clearance activity.

What to Watch Next Week

- Changes in THC discount depth and promotional volume will be the primary drivers of short term movement.

- CBD edibles and oils are most likely to influence CBD category shifts due to their pricing spread and volume concentration.

- Non consumable sectors are expected to remain stable, with movement driven by product mix rather than promotions.

Overall price distribution

CBD vs THC snapshot

CBD

- Products: 770

- Average price: $49.92

- Average discount: 12.1%

- Top subcategories:

- CBD Edibles: 319 products, $43.61 avg price, 20.3% discount

- CBD: 135 products, $39.93 avg price, 2.3% discount

- CBD Oil: 131 products, $70.21 avg price, 5.8% discount

THC

- Products: 2,108

- Average price: $28.19

- Average discount: 24.8%

- Top subcategories:

- THC Vape: 632 products, $31.40 avg price, 15.9% discount

- THC Edibles: 560 products, $32.73 avg price, 28.6% discount

- THC Pre-Rolls: 396 products, $15.27 avg price, 40.3% discount

Average price by subcategory

Average discount by subcategory

Other sectors (context)

- Headshop: 9,896 products, $56.25 avg price, 0.9% discount

- Vaporizers: 1,315 products, $74.91 avg price, 1.7% discount

- Grow: 1,281 products, $52.39 avg price, 0.4% discount

- Mushrooms: 79 products, $44.46 avg price, 9.8% discount

- Hemp: 93 products, $20.36 avg price, 3.3% discount

- Wellness: 47 products, $37.81 avg price, 6.3% discount

What to watch next week

- Discount activity remains concentrated in THC edibles and pre-rolls

- Headshop and Grow remain largely full price

- CBD movement likely driven by edibles and oils due to volume concentration