The bill, known as the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) received bipartisan support in the House of Representatives on Thursday, following its earlier passage in the Senate. A major policy priority for the Trump administration, the law sets out a federal framework for the use and regulation of stablecoins, a type of digital currency designed to maintain a stable value.

Trump and members of his inner circle have increasingly aligned themselves with the cryptocurrency industry in recent years, promoting digital finance innovation as a cornerstone of future U.S. economic growth.

The new law aims to make stablecoins more accessible to consumers and businesses, while also providing regulatory clarity a move expected to bolster innovation and expand financial inclusion.

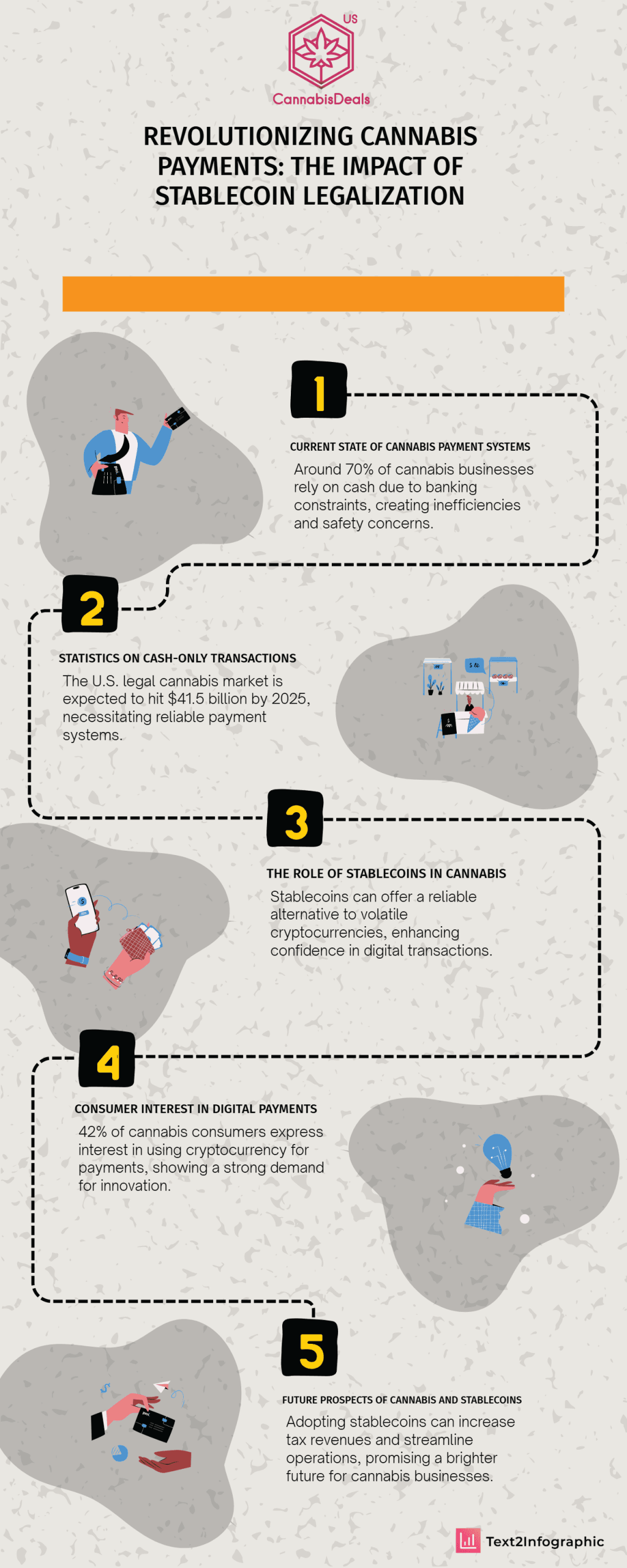

🔗 Trump signs 1st major federal cryptocurrency bill into law – ABC News 🔗 Congressional Interest in Digital Currencies – CRS ReportThe cannabis industry has been flourishing in recent years, with more and more countries legalizing the use of marijuana for medicinal and recreational purposes. However, the industry still faces many challenges, particularly when it comes to financial transactions. Due to the continued federal illegality of cannabis in many countries, traditional banking and financial institutions have been hesitant to work with businesses in the industry. This has resulted in limited access to banking services, causing major obstacles for businesses and consumers alike.Legal restrictions and regulations also pose significant challenges for the cannabis industry. While some states have legalized marijuana use, others still have strict laws in place that make it difficult for businesses to operate. This has created a complex regulatory landscape for cannabis businesses, making it challenging to navigate and comply with all the necessary regulations.These challenges have led to a reliance on cash payments within the cannabis industry, which can be risky for both businesses and consumers. Cash is susceptible to theft and fraud, creating safety concerns for businesses that deal with large amounts of money on a daily basis. For consumers, carrying large amounts of cash can also be inconvenient and unsafe.Fortunately, a potential solution has emerged in the form of stablecoins. A stablecoin is a type of cryptocurrency that is pegged to a stable asset, such as gold or fiat currencies like the US dollar. It offers the benefits of blockchain technology – fast, secure, and decentralized transactions – while also providing stability by being tied to a stable asset.Why This Matters for Cannabis

Despite state-level legalization, cannabis remains federally illegal leaving most businesses locked out of traditional banking. The result? A $30+ billion industry still heavily reliant on cash, with major risks in security, compliance, and growth.Challenges faced by the cannabis industry

The cannabis industry has seen significant progress in the past few years with the legalization of cannabis in many states. However, this does not mean that businesses in the industry are free from challenges. Despite the growing acceptance and support for cannabis, there are still legal restrictions and regulations that pose hurdles for businesses to operate successfully.These legal restrictions primarily stem from the federal government’s stance on cannabis, which still considers it illegal under federal law. This creates a complex legal landscape for businesses in the industry, making it difficult for them to operate across state lines and comply with different regulations in each state. As a result, many cannabis businesses face difficulties in expanding their operations and reaching new markets.Traditional banking and financial services are often unavailable to businesses in the cannabis industry due to their association with a federally prohibited substance. This means that these businesses cannot access basic financial services such as loans, credit card processing, or even bank accounts. This lack of access to traditional banking services not only hinders the growth of the industry but also poses risks for both businesses and consumers.Without access to basic financial services, businesses must rely on cash transactions, making them more vulnerable to security risks such as theft and fraud. Additionally, customers also face challenges when purchasing cannabis products as they often have to carry large amounts of cash with them, making them targets for crime.Despite these challenges, the potential for growth in the cannabis industry is immense. The market for legal cannabis is expected to reach $73.6 billion by 2027, according to a report by Grand View Research. However, in order to fully realize this potential, businesses need a secure and efficient payment solution that can overcome legal restrictions and provide ease of use for both businesses and consumers.This is where stablecoins come into play. Stablecoins are digital currencies that are backed by assets with stable values such as fiat currencies or precious metals. They offer a secure and transparent mode of payment that operates on a blockchain network, making it immune to government regulations and restrictions. By using stablecoins, businesses in the cannabis industry can overcome legal hurdles and have a more efficient means of conducting transactions.Additionally, stablecoins also offer significant cost-saving benefits for businesses. Without the need for traditional banking services, businesses can avoid hefty transaction fees and other costs associated with cash transactions. This can result in significant savings for businesses operating in the cannabis industry and contribute to their overall profitability.1. A Safe, Legal Way to Transact

A government-backed digital dollar could act as a neutral financial layer independent of banks. Cannabis businesses could legally send, receive, and store value digitally, while complying with AML/KYC rules via blockchain.“If cannabis businesses can legally transact in digital dollars, it could eliminate the need for physical cash and provide legitimacy to millions of dollars in transactions.” — Aaron Smith, National Cannabis Industry Association (NCIA)

What are stablecoins?

Stablecoins are a rapidly growing form of digital currency that is gaining traction in the cannabis industry. These cryptocurrencies are designed to have a stable value, making them less volatile than other cryptocurrencies such as Bitcoin or Ethereum. Stablecoins achieve this stability by being pegged to a stable asset, which can be fiat currency, commodities, or other cryptocurrencies. The concept of stablecoins has been around for a while, but their legalization is relatively new. In recent years, stablecoins have seen a surge in popularity due to the growing demand for alternative forms of payment in the cannabis industry. This is primarily because the traditional banking and financial services are largely inaccessible to businesses operating in the cannabis sector. One of the main benefits of stablecoins is their stability. Traditional cryptocurrencies, such as Bitcoin, are known for their high volatility – with prices fluctuating rapidly and unpredictably. This can make them risky and unreliable as a payment method. However, stablecoins provide a solution to this problem by maintaining a fixed value. Furthermore, stablecoins offer greater security and transparency compared to traditional forms of payment. As they are based on blockchain technology, every transaction involving stablecoins is recorded on a decentralized ledger, making it nearly impossible to manipulate or falsify records. This increased level of security can help alleviate concerns surrounding cannabis purchases, which are often viewed with skepticism due to the legal restrictions and stigma attached to the industry. In addition to security and stability, stablecoin adoption also brings improved efficiency to transactions within the cannabis industry. With traditional forms of payment, businesses may face delays in processing payments or encounter high transaction fees. These issues can be avoided with stablecoins, as they operate on a peer-to-peer network without any intermediaries involved. This allows for faster and cheaper transactions, ultimately benefiting both businesses and consumers. The use of stablecoins can lead to increased accessibility for businesses operating in the cannabis industry. By utilizing stablecoins as a form of payment, businesses can avoid the limitations and restrictions imposed by traditional banking and financial institutions. This not only allows them to conduct transactions with more ease but also opens up new opportunities for growth and expansion.🔗 Stablecoins Explained: Definitions, Mechanisms, and TypesStablecoin features:

One way stablecoins achieve this stability is by being pegged to real-world assets such as fiat currency or commodities like gold. This means that for every stablecoin in circulation, there is an equivalent amount of fiat currency or commodity held in reserve. For example, Tether, one of the most well-known stablecoins, is pegged 1:1 to the US dollar. This ensures that the value of Tether will always be equal to the value of the US dollar.Another mechanism used to maintain stability is through algorithmic supply adjustments. This means that when the demand for a stablecoin increases, more tokens are generated to meet the demand and keep the value stable. Similarly, when demand decreases, tokens can be burned or removed from circulation to maintain the desired stability.In addition to these mechanisms, some stablecoins also offer redeemability, which means that users can exchange their stablecoins for the underlying asset at any time. This adds another layer of trust and security for users as they have the assurance that their assets are backed by tangible reserves.Overall, these features make stablecoins a more reliable and secure form of digital currency compared to traditional cryptocurrencies. The stability offered by stablecoins makes them an attractive option for businesses operating in industries with high levels of volatility, such as the cannabis industry.2. Banking Functionality Without Banks

Digital dollars, or regulated stablecoins, could provide core banking functions:- payroll

- supplier payments

- customer transactions

- tax filings

More efficient supply chain management

Stablecoin adoption in the cannabis industry has the potential to revolutionize supply chain management. With traditional payment methods, purchasing and transporting cannabis products can often be a complicated and time-consuming process. However, with the use of stablecoins, this process can be streamlined and made more efficient.One of the main benefits of stablecoin transactions is real-time tracking. Traditional payment methods may face delays and complications, but stablecoin transactions offer faster processing times, allowing businesses to track their supply chain in real-time. This not only increases efficiency but also enables businesses to have better control over their inventory and ensure timely delivery to their customers.Crypto and stablecoins can provide a secure and immutable record of all transactions within the supply chain. By leveraging blockchain technology, all transactions are recorded on a decentralized ledger, making it nearly impossible for any fraudulent activity to take place. This level of transparency and security is crucial in the cannabis industry where strict regulations are in place.In addition to real-time tracking and security, stablecoin adoption can also reduce costs for businesses in the cannabis industry. Traditional payment methods often involve intermediaries such as banks or payment processors, which charge fees for their services. With stablecoins, these intermediaries are eliminated, resulting in lower transaction costs for businesses.3. Lower Fees & Less Fraud

Current cannabis payment workarounds can charge 3–10% per transaction. A national digital dollar could reduce these costs and create transparent audit trails to deter fraud.🔗The Future of Blockchain and Market Disruptors | Deloitte USOne of the primary reasons why stablecoins can reduce costs is because they operate on a decentralized system. This means that there is no central authority controlling the transactions, unlike traditional banking systems. As a result, businesses do not have to pay hefty fees to banks or financial institutions for processing their transactions. This can lead to significant savings, especially for small and medium-sized cannabis businesses.The use of stablecoins can also eliminate the need for cash transactions, which can be costly for businesses. The cannabis industry has been known to face challenges with accessing banking services due to federal restrictions and regulations. As a result, many businesses are forced to rely on cash transactions, which come with their own set of costs and risks. Cash handling fees, security measures, and the risk of theft are all expenses that businesses have to bear when dealing with cash transactions. However, with stablecoins, all transactions are conducted digitally, eliminating these additional costs and risks.Consumers will no longer have to worry about carrying cash or facing payment restrictions due to federal regulations with the use of stablecoins. This opens up opportunities for both small and large businesses in the cannabis industry to tap into a wider range of customers who may have previously been deterred by the inconvenience and safety concerns associated with cash transactions. By providing a more accessible payment option, businesses can create a competitive edge and attract more customers.Small businesses in the cannabis industry can also level the playing field with big corporations by utilizing stablecoins for transactions. Before stablecoins, big corporations had an advantage as they could afford to set up complicated and costly payment systems to cater to their customers’ needs. Small businesses, on the other hand, were limited in their capabilities due to financial constraints. With stablecoins, both small and large businesses can operate on an equal footing in terms of transaction accessibility without incurring high costs.4. Catalyst for Federal Reform

Participation in digital infrastructure may position cannabis businesses closer to federal recognition. As they integrate into national payment systems, it strengthens arguments for SAFE Banking Act–style reforms.🔗 SAFE Banking Act on Congress.govThe use of crypto or stablecoins will also have a positive impact on consumer trust and satisfaction within the cannabis industry. As cash remains the predominant method of payment in this industry, there are concerns around security and transparency. With traditional payments, there is always a risk of fraud or theft during cash transactions. However, with stablecoins, all transactions are recorded on a blockchain network providing greater transparency and reducing risks. This increased security can help build trust between businesses and consumers, ultimately leading to increased satisfaction. It also provides consumers with a secure and convenient way to make purchases without having to carry large amounts of cash.With privacy in mind, stablecoins also offer increased privacy for customers when making purchases. The parallel nature of blockchain technology allows for anonymity in transactions, providing customers with a sense of privacy and security in their purchases. In an industry where stigma still exists, this can be a crucial factor for many individuals when deciding whether or not to purchase cannabis products.

5. Crypto Integration Could Enable Global Trade

Many cannabis businesses already use Bitcoin and Ethereum for retail. A digital dollar framework could create hybrid systems for global B2B payments regulated at home, crypto-powered abroad.🔗 Crypto: The basics | FCA🔗Stablecoins payments infrastructure for modern finance | McKinseyStablecoins have gained attention from various industries due to their potential to offer a secure and efficient means of payment. However, their potential impact on the cannabis industry could be revolutionary. By leveraging stablecoins as a form of payment, cannabis businesses could potentially overcome many of the challenges they currently face.The use of crypto and stablecoins can lead to a more efficient supply chain by eliminating manual processes and paperwork. All transactions are recorded on the blockchain, reducing the need for paperwork and manual data entry. This not only saves time but also reduces the risk of human error, leading to a more accurate and efficient supply chain management system.The introduction of stablecoins could lead to a more competitive and dynamic landscape within the cannabis industry. As more businesses adopt this payment method, it will create a ripple effect throughout the entire industry. Traditional banking and financial institutions may face disruption as they struggle to keep up with the convenience and efficiency offered by stablecoin transactions. This could pave the way for new financial models that are specifically tailored for the cannabis industry.As digital currencies, stablecoins are not tied to any specific geographical location or government regulations like traditional currencies are. This means that businesses can transact globally without worrying about cross-border restrictions or currency exchange rates. For consumers, this means increased access to a wider range of products from different regions or countries.Final Thought: A Turning Point?

The legalization of digital dollars may unlock true financial access for the cannabis industry. While full legalization remains a political issue, financial normalization is already on the horizon.“The digital dollar could be to cannabis what the internet was to media — a way to unlock scale, transparency, and innovation in a sector stifled by outdated infrastructure.” — Theo Valmis, CannabisDealsUS.comStablecoin legalization has the potential to revolutionize the way cannabis is bought and sold. To understand its impact on the industry, we must first look at the current state of cannabis purchases. Despite the legalization of cannabis in many states, the industry still faces several challenges, particularly when it comes to payments.As mentioned earlier, one of the main obstacles facing the industry is federal regulations and restrictions. Cannabis remains a Schedule I drug at the federal level, meaning it is considered illegal under federal law. This has created a significant roadblock for businesses in the industry as they are unable to access traditional banking services that most other legitimate businesses have access to.The lack of banking services has led to businesses operating mainly in cash. According to a 2017 study by New Frontier Data, approximately 70% of all cannabis sales were conducted in cash. This not only poses risks for businesses but also creates inconveniences for consumers who prefer electronic payment options. Cash transactions also make it difficult for businesses to track and manage their finances effectively, hindering their ability to invest in growth opportunities such as expanding their product lines or opening new locations.Without access to traditional banking services, cannabis businesses have limited options for managing their funds. They cannot open business accounts or obtain loans and credit card processing services, which are crucial for any business looking to expand and thrive.Overall, the current state of cannabis purchases is hindered by federal regulations and restrictions that prevent businesses from accessing basic banking services and conducting digital transactions. This creates inefficiencies and limitations that hold back the industry’s growth and potential. The legalization of stablecoins could provide a viable digital payment solution for the cannabis industry. These cryptocurrencies offer increased security and transparency compared to cash transactions or traditional payment methods.

More Resources

- Federal Reserve and CBDC

- Navigating Cannabis Payment Solutions: A Guide for Retail Operators

- CRS Report: Crypto Regulation

- SAFE Banking Act – NORML